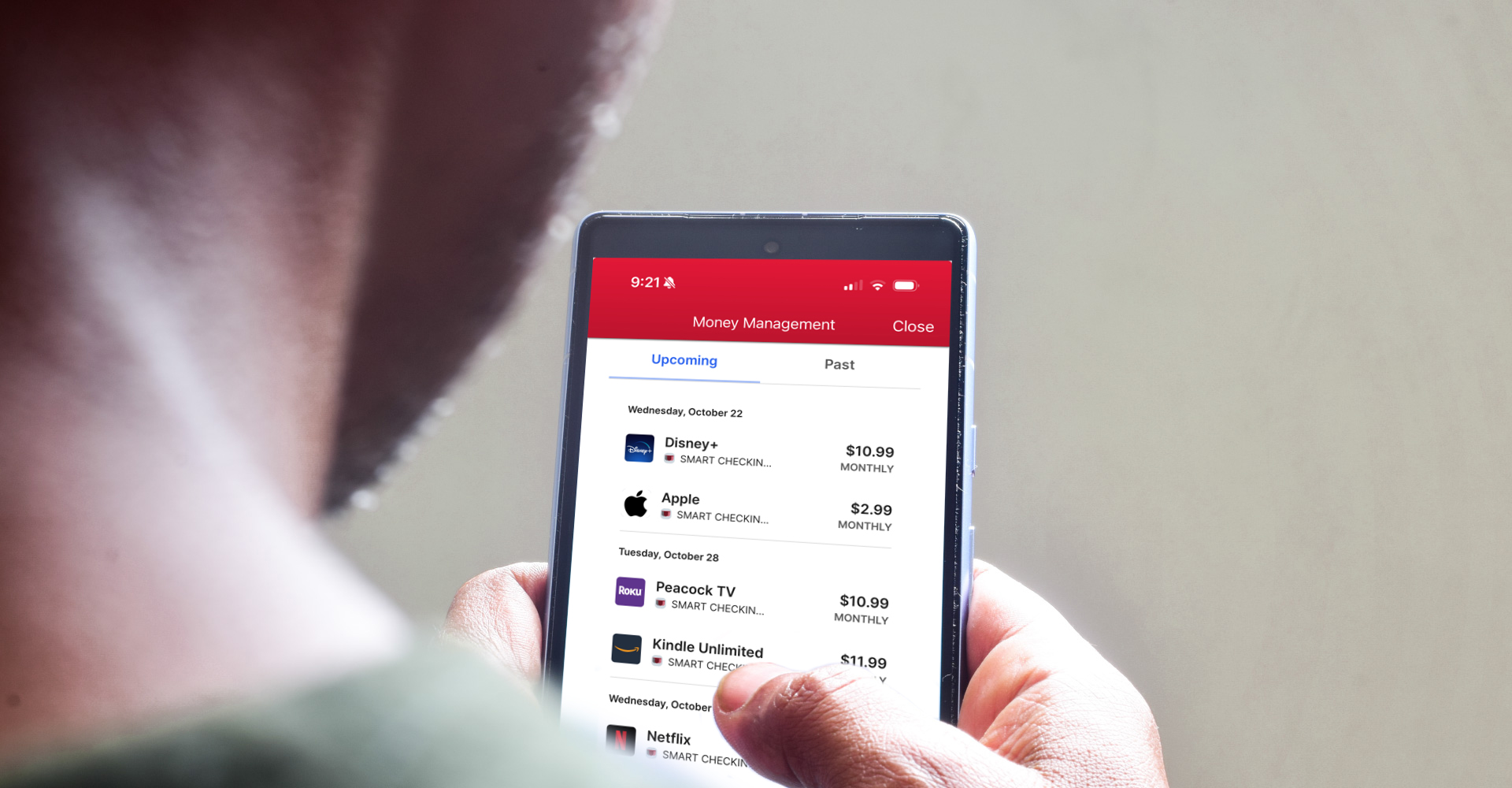

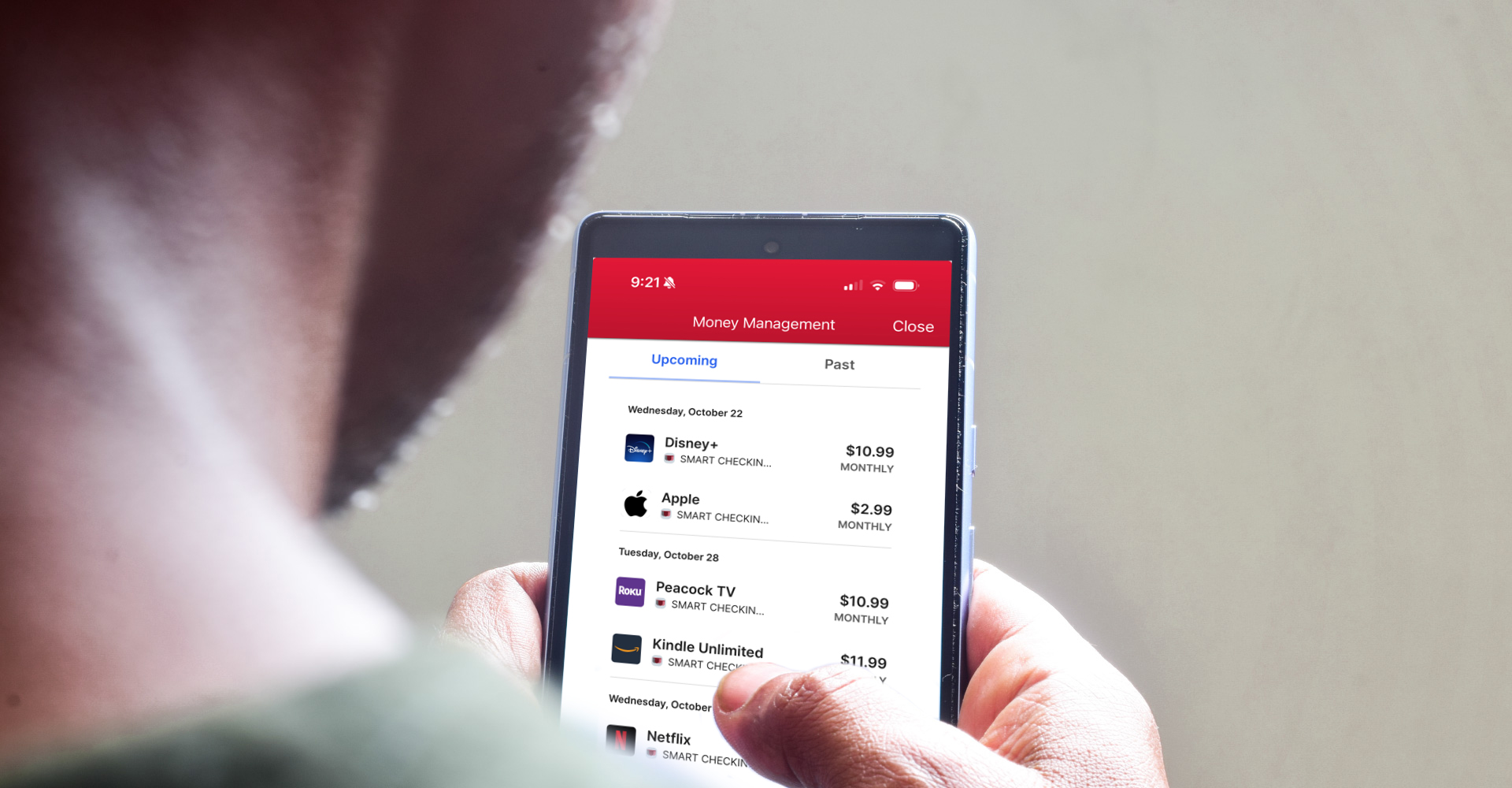

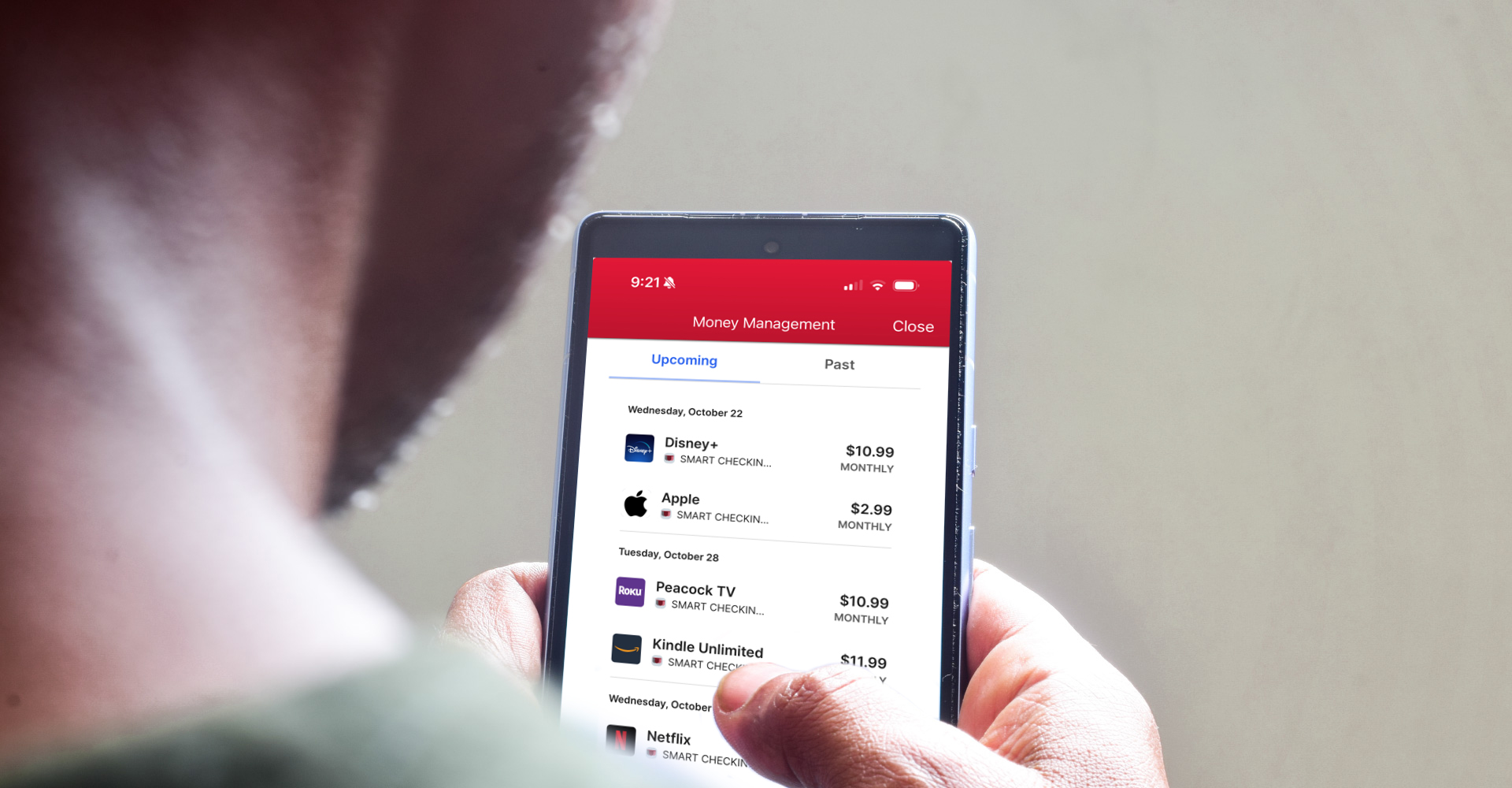

How to Manage the Subscription Crunch

One way to get the most out of your budget is to reduce subscription expenses. Here are some things to consider when managing subscriptions.

How do you build financial security? Planning and education. A good place to get educated? Our library of free resources.

One way to get the most out of your budget is to reduce subscription expenses. Here are some things to consider when managing subscriptions.

Sort & Filter

Sort & Filter

One way to get the most out of your budget is to reduce subscription expenses. Here are some things to consider when managing subscriptions.

Summer vacation season is a prime time for phishing campaigns that promote fake travel offers. Consider these strategies to steer clear of scams and hang on to your money.

Whether you’re a first-time home buyer, thinking about building, or taking steps towards purchasing an investment property, it’s important to start the process by being well prepared.

If you are thinking about starting some home improvement projects, you can be strategic about which ones to tackle first.

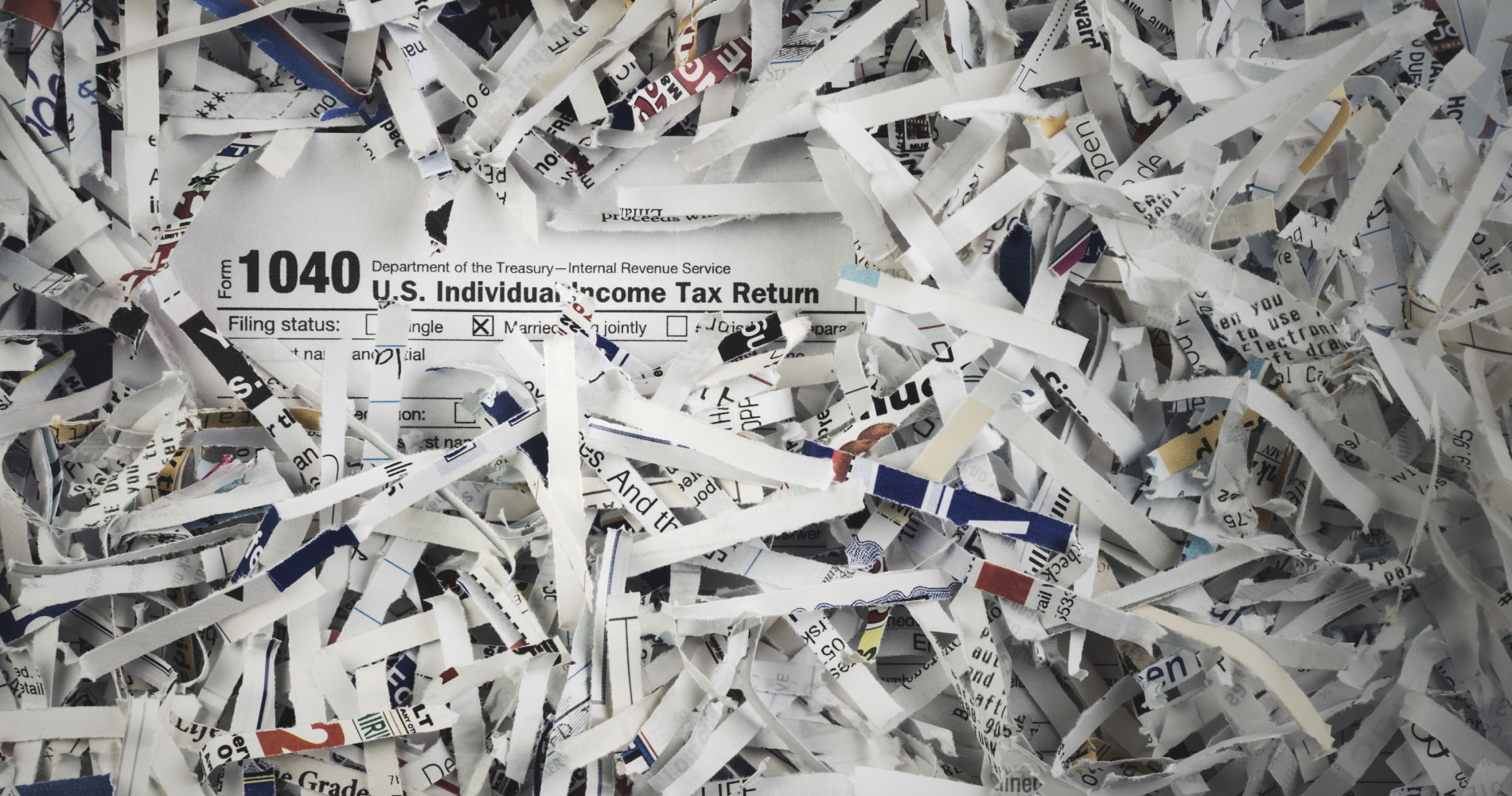

Taking steps to protect your personal information can help you avoid tax identity theft. Learn how to stay ahead of identity thieves with these helpful tips from the Federal Trade Commission.

Searching for your first home can be an exhilarating, yet overwhelming time in your life. If you are having trouble with where to start, you are not alone. With some guidance and organization, German American can help you be on your way to owning your first home. Here are some simple steps to get you started.

According to a recent survey, 30 percent of American adults say they don’t pay all their bills on time, causing them to pay extra interest and lofty late payment fees. Autopay and bill pay tools allow you to set up automatic payments for your recurring monthly bills. Understanding the details of how to make these systems do their best for you can help to save you money!

As you look forward to achieving new goals, we're here to provide the tools and resources you need to protect your financial well-being. We encourage you to be an active partner in preventing fraud and identity theft. Here are some healthy habits to be scam smart!

Encouraging financial education for young learners may be a way a good way to build a foundation of sound financial principles. Parents, caregivers, mentors, grandparents – anyone who has a positive influence over teens and young adults – can help them learn solid money lessons before they go off to college or get their first job.

You can be an active partner in preventing fraud by keeping your personal information safe. Learn how to protect yourself from criminals who may try to steal your personal or financial information with these helpful tips.

Benjamin Franklin once said, “An ounce of prevention is worth a pound of cure.” There is no more appropriate mission statement when it comes to retirement and the potential surprises that might arise during this important life stage. Proactive prevention establishes financial awareness that will help mitigate these surprises and create retirement longevity for your investment portfolio.

It’s hard to learn the true value of money without actually having some money to save and spend. That’s why setting aside a specific amount each week as an allowance for your children can be a good way to show them, among other things, that cash is a limited resource.

Moving into your own place can be exciting and frightening at the same time. The American Bankers Association suggests considering the following questions when choosing your own home.

What is credit and why is it important? What does it mean to be in debt? In what instances should you use credit? Find answers to these important questions, key words, conversation starters, and real world applications to start talking to your family about borrowing money and credit cards.

An emergency fund is a vital part of healthy finances. If there’s one constant in life, it’s that it is not constant. Unexpected expenses appear out of thin air. You could suddenly find yourself unemployed. There is no way to see the future, which is why an emergency fund is so important. It provides a cushion should you stumble financially. Here’s everything you need to know about this fund.

Before making the transition from renting your home to owning your home, it is important to start saving for a down payment, typically 5 to 20 percent of the home’s value. Check out some helpful tips from the American Bankers Association on how to save for it.