One way to get the most out of your budget is to reduce subscription expenses. Here are some things to consider when managing subscriptions.

Subscription Needs and Wants

When looking at your subscription costs, you should ask yourself what value they provide. Ask yourself if it’s a need or a want.

- Need. Maybe you pay a monthly fee for a budgeting app that truly helps you keep finances in order. That’s beneficial.

- Need. Are the subs providing health benefits, like a meditation app or a gym membership?

- Want. Maybe you subscribe to some items that are purely entertainment, which also provide value in their own way.

If you come across some subscriptions that you struggle to find the value they provide, that’s a sure sign to cut them immediately.

How Autopay Hurts

Subscriptions are great because they come with autopay. You simply set it and forget it. However, autopay is a double-edged sword. It’s great that you don’t have to think about the payments and therefore are never late. It’s not so great that you don’t think about the payments and thus pay for subscriptions you don’t want or no longer need.

Pay Attention to Your Budget

The best way to avoid paying too much for subscription costs is to actually pay attention to them. Being mindful of the money coming in and going out will help you catch autopayments you may have forgotten about. Here are some ways to help:

- Make a spreadsheet of your monthly subscriptions and their costs.

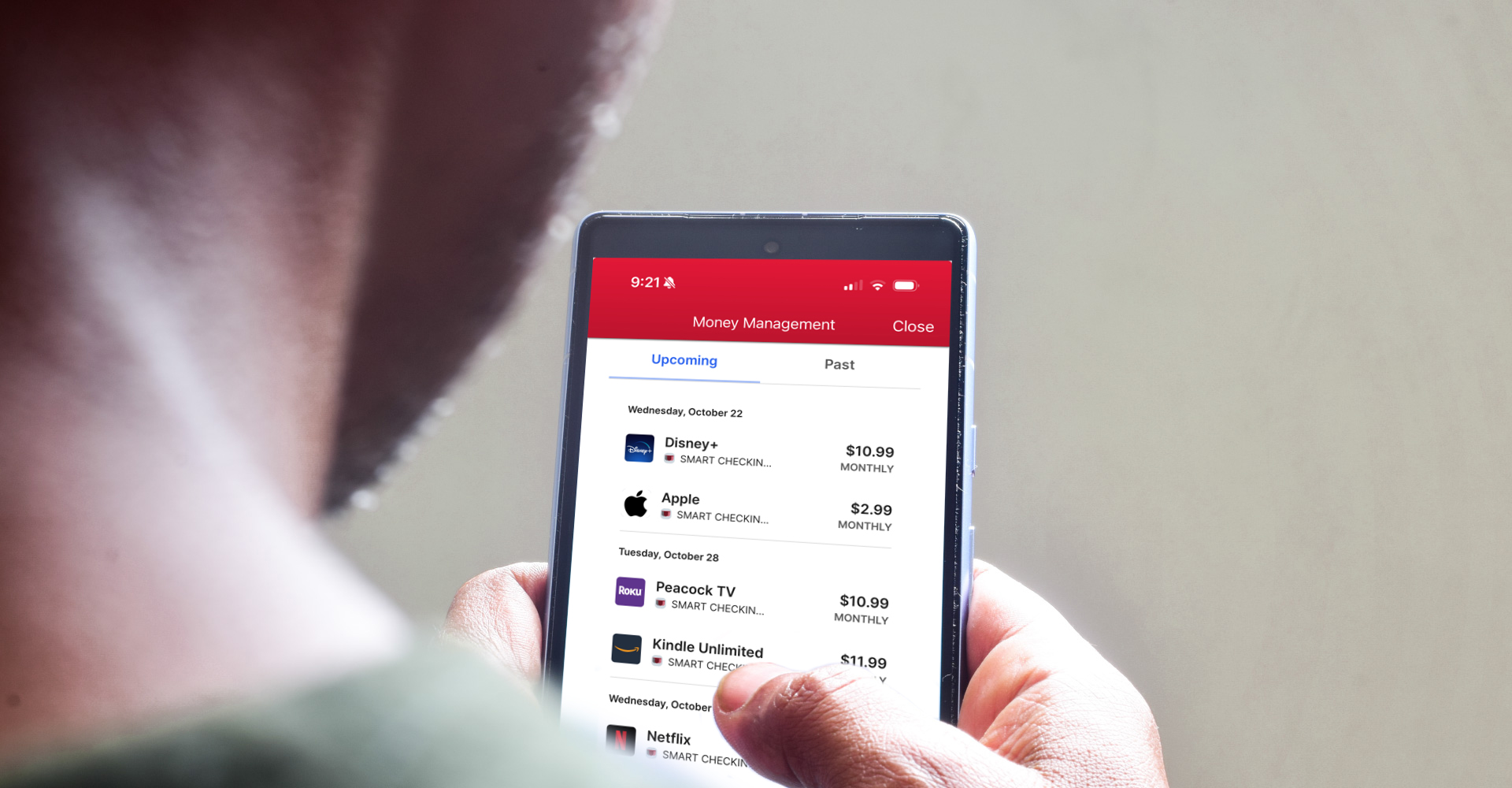

- View a snapshot of subscription expenses in Financial Tools, an easy-to-use budgeting tool located within Heartland Bank Online and Mobile Banking!

- Each month, go back to that list and ask yourself if the subscription still provides value or has become too expensive.

- Simply being mindful of your subscriptions will go a long way to cutting back on those costs.

Do One Thing: Check on your subscription costs now so that they don’t hurt future spending or savings goals.

Written by Chris O'Shea for SavvyMoney

Email

Email

App Store

App Store